truck insurance usa. Truck insurance is a specialized type of coverage designed to protect trucking companies and independent truck drivers from various financial risks associated with their operations. In the USA, the trucking industry plays a pivotal role in the economy, facilitating the transport of goods across the nation. Given the significant responsibilities and potential hazards involved, having comprehensive truck insurance is not only a prudent business decision but also a legal necessity.

Truck insurance policies typically encompass a range of coverages tailored to address the unique risks faced by truck operators. These include, but are not limited to, primary liability insurance, which covers damages or injuries inflicted upon others in an accident where the truck driver is at fault. Another essential component is physical damage insurance, protecting the truck itself against collision, theft, and other perils. Additionally, cargo insurance safeguards the goods being transported, ensuring that shippers and receivers are compensated for any losses or damages that occur during transit.

The necessity of truck insurance extends beyond financial protection. Federal and state regulations mandate minimum insurance requirements for trucks operating within and across state lines. For instance, the Federal Motor Carrier Safety Administration (FMCSA) enforces rules requiring motor carriers to carry minimum levels of liability insurance based on the type of freight being hauled and the truck’s weight. Failure to comply with these mandates can result in heavy fines, suspension of operating licenses, and even legal action.

Understanding and acquiring the right truck insurance can be complicated, given the variety of coverages and regulatory requirements involved. However, it is a critical step in ensuring the smooth and secure operation of any trucking business. Robust truck insurance not only mitigates the financial fallout from accidents and other incidents but also enhances the credibility and reliability of the trucking company in the eyes of clients and regulatory bodies.“`

Types of Truck Insurance Coverage

When navigating the realm of truck insurance in the USA, understanding the different types of coverage available is crucial for ensuring adequate protection. Each type serves a unique function, safeguarding various aspects of trucking operations and addressing specific risks. Here, we provide a comprehensive overview of the main types of truck insurance coverage: liability insurance, physical damage insurance, cargo insurance, bobtail insurance, and non-trucking liability insurance.

Liability Insurance: This fundamental coverage is a legal requirement for all commercial trucks. Liability insurance covers bodily injury and property damage that the truck driver might cause to others in a road accident. It ensures that the trucking company or independent driver can cover the costs associated with medical bills, legal fees, and property repairs or replacements. This type of insurance is indispensable in protecting against financial loss and potential lawsuits resulting from accidents.

Physical Damage Insurance: This coverage is designed to protect the truck itself. Physical damage insurance typically comprises two components: collision coverage and comprehensive coverage. Collision coverage pays for damages to the truck resulting from a collision, while comprehensive coverage addresses non-collision-related damages, such as those caused by theft, vandalism, fire, or natural disasters. Physical damage insurance is critical for maintaining fleet assets.

Cargo Insurance: Also known as freight insurance, cargo insurance covers the goods being transported by the truck. This policy reimburses the trucking company or owner-operator for loss or damage to the cargo due to accidents, theft, or other perils. It’s particularly vital for those hauling high-value goods, ensuring that clients’ shipments are protected throughout transit, thus maintaining trust and business reputation.

Bobtail Insurance: Sometimes referred to as deadhead insurance, bobtail insurance provides coverage for trucks operating without a trailer. This insurance is applicable even when the truck is being driven for non-business purposes, such as returning home after making a delivery. Bobtail insurance protects against liability in events where the truck is involved in an accident without a trailer attached, ensuring continuous coverage.

Non-Trucking Liability Insurance: This type of coverage overlaps somewhat with bobtail insurance, offering protection during non-business use of the truck. Non-trucking liability insurance covers personal errands or trips unrelated to the business when the truck is not under dispatch. It’s an essential policy for owner-operators who frequently use their trucks for personal use, providing peace of mind beyond commercial activity.

Understanding the nuances of these different types of truck insurance coverage allows trucking professionals to make informed decisions, ensuring comprehensive protection tailored to their specific needs and operational circumstances.

Federal and State Regulations on Truck Insurance

The regulation of truck insurance within the United States is a dual system governed by both federal and state laws. The Federal Motor Carrier Safety Administration (FMCSA) establishes the foundational requirements for commercial trucking insurance. Specifically, the FMCSA mandates that trucks engaged in interstate commerce carry a minimum level of liability insurance, which varies based on the type of cargo being transported. For example, general freight trucks must have a minimum of $750,000 in liability coverage, while those transporting hazardous materials may need up to $5,000,000 in coverage. This ensures that adequate funds are available to cover potential damage or injury claims resulting from accidents.

The Motor Carrier Act of 1980 further reinforces these requirements by necessitating proof of financial responsibility. Carriers must file a Form MCS-90 endorsement with their insurance provider, certifying that they meet the required insurance limits. This regulation aims to protect public welfare by ensuring motor carriers can cover liabilities arising from transportation-related incidents.

While federal regulations provide a broad framework, state laws can impose additional requirements on truck insurance. For instance, California mandates higher minimum liability limits than the federal standard, requiring commercial trucks to have at least $1,000,000 in coverage. Similarly, Texas has specific regulations regarding the transport of oilfield equipment, compelling carriers to obtain additional insurance to address the heightened risks associated with this cargo. These variations between states make it imperative for trucking companies to be well-versed in both federal mandates and the specific requirements of each state they operate in.

Moreover, states like Florida have unique rules governing the intrastate transportation of goods, often necessitating additional insurance policies or higher coverage limits for trucks operating solely within state boundaries. These differences highlight the complexity of compliance and the necessity for carriers to engage proactively with insurance providers to ensure all regulatory requirements are met. The interplay between federal and state regulations creates a comprehensive safety net but also necessitates diligent management to navigate successfully.

Factors Influencing Truck Insurance Premiums

Truck insurance premiums can vary significantly based on several critical factors. Insurers consider these aspects meticulously to assess the risks and determine the appropriate cost of coverage. An understanding of these variables is essential for trucking companies to manage their insurance expenses effectively.

Driver Experience and History: One of the most consequential factors is the driver’s experience and driving history. Insurers typically offer lower premiums to drivers with extensive experience and a clean driving record. A history of accidents, traffic violations, or DUIs can lead to substantially higher rates because these indicate a higher likelihood of future claims. Hence, maintaining a clean driving record and investing in driver training programs can be beneficial.

Type and Age of the Truck: The make, model, and age of the truck are also significant determinants. Newer trucks equipped with advanced safety features typically attract lower premiums due to their reduced risk of accidents. Conversely, older trucks may have higher insurance costs due to potential mechanical failures and lack of modern safety technology. Regular maintenance and timely upgrades can help mitigate these costs.

Nature of the Cargo: The type of cargo being transported influences premium rates. Hazmat (hazardous materials) loads or high-value goods pose higher risks, consequently driving up insurance costs. Efficient cargo management, adherence to safety regulations, and utilizing appropriate securement devices can help manage these expenses.

Distance Traveled: The distance a truck travels also impacts premiums. Trucks that cover extensive miles are exposed to a higher risk of accidents, leading to increased insurance costs. Implementing strategic route planning to optimize travel distances and minimize exposure to hazardous conditions can be an effective cost-control measure.

Overall Safety Record: The trucking company’s overall safety record, including previous claims and compliance with safety regulations, significantly impacts insurance premiums. Companies with a history of frequent claims or safety violations face higher insurance costs. Fostering a culture of safety, conducting regular training sessions, and adhering to regulatory standards can enhance the safety record and, in turn, reduce premium expenses.

In summary, understanding and managing the diverse factors influencing truck insurance premiums can result in more affordable insurance solutions. By focusing on driver qualifications, vehicle upkeep, cargo management, route optimization, and overall safety protocols, trucking companies can navigate the complexities of insurance costs more effectively.

How to Choose the Right Truck Insurance Policy

Choosing the right truck insurance policy is a critical decision for any truck owner or operator. The first step in this process is to assess your specific needs. This involves evaluating the types of truck insurance coverage required based on factors such as the kind of cargo you transport, the distance you travel, and the operational risks associated with your business. Understanding these elements helps in identifying the essential coverage options, such as liability insurance, cargo insurance, and physical damage coverage.

Next, it’s imperative to compare quotes from multiple insurers. This practice not only ensures that you get competitive rates but also helps you understand the different offerings available. Obtain at least three quotes and scrutinize each one carefully. Pay attention to the premiums, deductibles, and the scope of coverage provided. It’s also beneficial to review the insurer’s reputation, customer service record, and financial stability to ensure you choose a reliable provider.

Understanding the policy terms and conditions is equally important. Insurance contracts can be complex, with detailed clauses and exclusions that can impact your coverage significantly. Take the time to read through the policy document thoroughly. Clarify any ambiguities with the insurance provider, and don’t hesitate to ask for detailed explanations of terms you don’t understand. This step helps in minimizing surprises in the event of a claim.

Consulting with insurance brokers or experts is another wise move. These professionals possess extensive knowledge of the insurance market and can provide valuable insights tailored to your specific needs. An insurance broker acts as an intermediary, working on your behalf to find the best policy that offers comprehensive coverage at a reasonable price. They help in navigating the intricacies of different insurance products and ensure you are adequately protected.

Finally, when choosing a truck insurance policy, balance the value of comprehensive coverage against cost savings. While it might be tempting to opt for the least expensive policy, it’s crucial to ensure that the coverage is sufficient to protect your business from potential losses. Investing in a well-rounded insurance policy can provide peace of mind and financial protection in the face of unforeseen events.

Top Truck Insurance Providers in the USA

Choosing the right truck insurance provider is paramount for anyone operating in the trucking industry. Numerous insurance companies offer specialized policies tailored to the unique needs of truck owners and operators. Here, we provide an overview of some of the top truck insurance providers in the USA, emphasizing their specialty areas, policy types, notable features, and overall reputation.

Progressive Commercial: As a leader in the commercial truck insurance market, Progressive Commercial offers a variety of policies ranging from liability insurance to cargo insurance. Their specialty extends to cover both small and large fleets. Progressive’s notable features include 24/7 claims processing and a comprehensive online resource center. They have earned a solid reputation for customer service and efficient claims handling.

Nationwide: Known for their extensive coverage options, Nationwide provides policies that include primary liability, physical damage, and motor truck cargo insurance. They are particularly recognized for their flexible payment plans and various discounts. Customers have praised Nationwide for their personalized service and knowledgeable agents, making it a top choice for truck insurance.

The Hartford: The Hartford stands out with its tailored commercial truck insurance policies that cater to different types of trucks, including tow trucks and delivery trucks. They offer specialized coverage such as motor truck general liability and non-trucking liability insurance. The Hartford’s claims process is noted for its efficiency, and their risk engineering services provide additional value to policyholders.

Travelers: Travelers provides comprehensive commercial truck insurance with options like auto liability, physical damage, and cargo insurance. Their specialty lies in providing bespoke insurance solutions that address the specific needs of large fleets. Travelers’ claim to fame is their robust risk control services and the accessibility of a dedicated claims team, making them a reliable choice for many in the trucking industry.

GEICO Commercial: Part of GEICO, a widely known insurance company, GEICO Commercial offers competitive rates on truck insurance. They focus on smaller trucking operations, providing essential coverages such as liability and physical damage insurance. Known for their easy-to-use online platform and excellent customer service, GEICO Commercial is a preferred choice for smaller trucking businesses seeking straightforward insurance solutions.

These top providers have distinguished themselves in the industry through a combination of comprehensive coverage options, exceptional customer service, and efficient claims processes. Evaluating these factors can help truck owners and operators make informed decisions to protect their assets and ensure the smooth operation of their businesses.

Claims Process for Truck Insurance

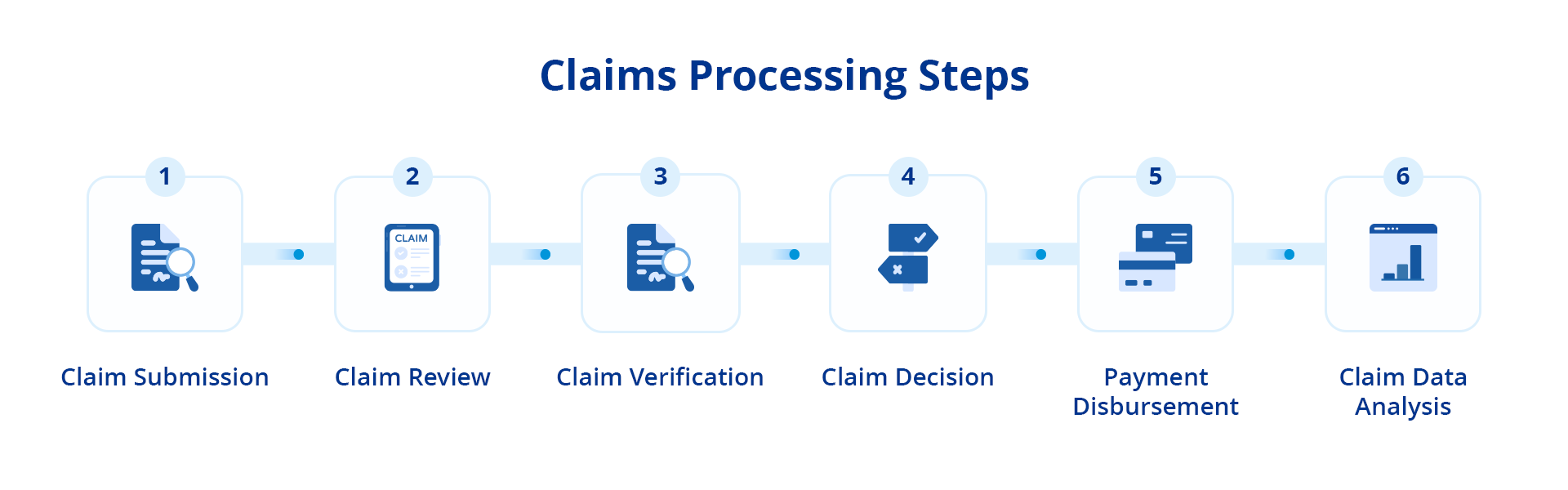

The claims process for truck insurance in the USA is designed to ensure that truck owners and operators can recover from accidents, thefts, or damages efficiently and fairly. Understanding the claims process can significantly affect the outcome and speed of your claim, ensuring minimal disruption to your operations.

The first step in the claims process is reporting the incident. It’s imperative to notify your insurance company as soon as an incident occurs. This initial notification should be prompt; most insurers have a specified period within which you must report the claim. Immediate reporting helps initiate the claims process swiftly and allows the insurance company to begin its investigation without unnecessary delays.

Next, you will be required to submit necessary documentation. Key documents often include a completed claims form, police reports if applicable, photographs of the damage, and any evidence of ownership or maintenance records. Accurate and comprehensive documentation is essential as it facilitates a smoother verification process and helps avoid potential delays.

Insurance adjusters play a crucial role in the claims process. Once your claim is reported and the initial documents are submitted, an insurance adjuster is typically assigned to your case. The adjuster’s role is to assess the damage or loss, verify the details of the claim, and determine the amount payable based on the policy terms. Effective communication with the adjuster is vital—provide prompt responses to their requests and offer any additional information they might need.

The insurance company will then evaluate the adjuster’s report, along with the submitted documentation, to make a decision on the claim. This step may result in the approval, adjustment, or denial of the claim, depending on the circumstances and adherence to policy conditions.

To ensure a smooth claims process, timely reporting and accurate record-keeping are paramount. Maintaining open and efficient communication with your insurer and adjuster can significantly enhance the process. By adhering to these guidelines, truck owners and operators can navigate the claims process more effectively, potentially reducing downtime and financial impact.

Future Trends in Truck Insurance

The truck insurance industry is poised for significant transformation in the coming years, influenced by shifts in regulations, technological advancements, and changing market dynamics. Stakeholders must keep abreast of these emerging trends to navigate the evolving landscape effectively.

One of the primary drivers of change in truck insurance regulations is the push for enhanced safety standards. Regulatory agencies are continually updating requirements to reduce accidents and improve overall road safety. These changes can impact insurance premiums and coverage options, prompting carriers to adapt their policies accordingly. For example, stricter liability rules and mandatory safety features on trucks could lead to higher premiums, as insurers account for the increased risk.

Technological advancements, particularly in telematics and autonomous driving, are also set to revolutionize truck insurance. Telematics systems, which collect data on driving behavior and vehicle performance, provide insurers with valuable insights to assess risk more accurately. This data-driven approach enables the development of personalized insurance products, potentially leading to fairer premiums based on individual driving patterns. Additionally, the rise of autonomous trucks introduces new risk factors and liabilities, requiring insurers to develop innovative policies that address the unique challenges posed by these technologies.

Furthermore, the integration of telematics can enhance claims processing efficiency, reducing administrative costs and potentially lowering premiums for insured parties. The predictive analytics capabilities enabled by telematics data can also aid in identifying high-risk behaviors, allowing for proactive intervention and risk mitigation.

As the truck insurance landscape evolves, new opportunities and risks will emerge. For instance, the growing emphasis on cybersecurity poses a dual challenge: protecting sensitive telematics data and managing cyber risks associated with autonomous trucks. Insurers will need to offer coverage solutions that address these concerns while educating clients on best practices for data security.

To stay prepared for these developments, stakeholders should invest in continuous learning and leverage advancements in technology to enhance their risk management strategies. By embracing innovation and proactively adapting to regulatory changes, the trucking industry can secure more comprehensive and cost-effective insurance coverage, paving the way for a safer and more sustainable future.